The SWaN Hill Top House Hotel, LLC has applied for a “Tax Increment Financing” (TIF) district to be created by the Jefferson County Commission at the location of its hotel in Harpers Ferry.

What is a TIF?

A tax increment financing district is a delineated area (the “district”) where for a period of time (up to 30 years in WV) taxes paid on the value of real property in the district over the amount assessed at the start of the time period (the tax increment) are placed in a separate fund (the TIF fund) and are used only to finance projects and improvements within that district.

For example, let’s say a 10-acre area is designated a TIF for a period of 30 years. At the time it was designated a TIF the taxes on the property were assessed to be $100 per year. In the first year, improvements on the land and the land value itself increased such that the taxes on the property were assessed to be $400. The $100 will still be paid to the levying body and the additional $300 (the tax increment) will be put in a TIF fund. The TIF fund is used by the developer to finance the development and other improvements in the district as the developer sees fit. Every year for the period of the TIF this same thing will occur: $100 will continue to go to the levying body and any amount over that will go to the TIF fund to finance improvements only in that district.

The money in the TIF fund can be used in a “pay as you go” fashion or bonds can be issued to provide the developer up front funding. In the pay as you go set up, the developer uses the money in the TIF Fund after the taxes have been paid and deposited in the fund. With the bonds, the money paid into the TIF fund goes to service the bonds and any excess money in the TIF fund after servicing the bonds can be used by the developer in a pay as you go fashion.

What is happening here?

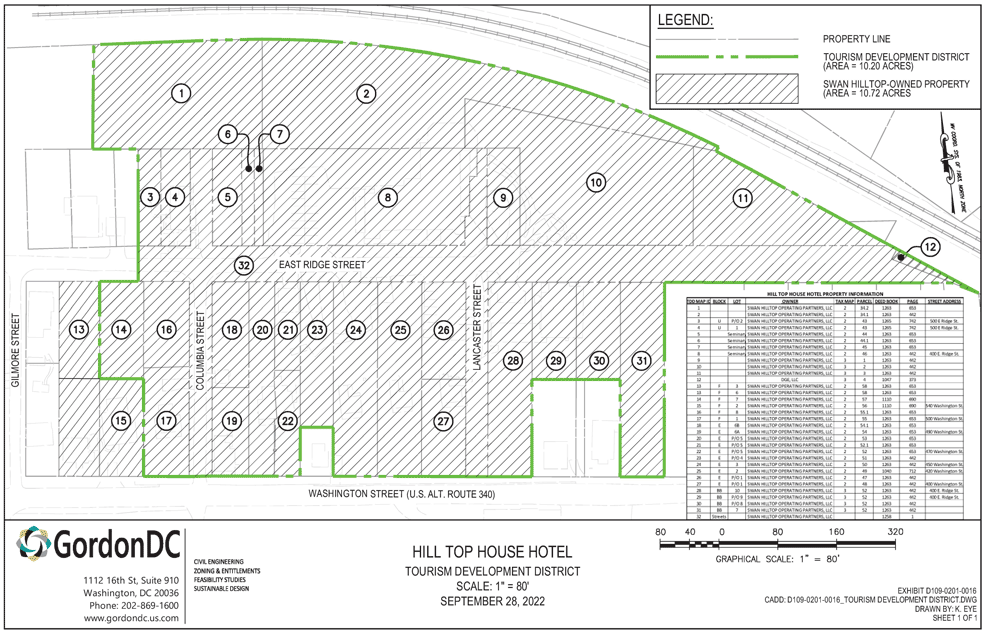

The SWaN Hill Top House Hotel, LLC has applied to have the area of the Hill Top Hotel and several surrounding lots designated as a TIF district for a period of 30 years. This is the maximum allowed by WV law (§7-11B-10). The amount of taxes that the municipality of Harpers Ferry and Jefferson County (including the school system) will receive from the district and the newly developed hotel will not increase for 30 years. This is because any additional taxes paid due to the improvements on the land or the increase in value of the land itself will be diverted in into the TIF fund.

What is required for a TIF?

Among other things, the act (§7-11B. The West Virginia Tax Increment Financing Act) requires that:

- the area designated as the district will “be benefitted by eliminating or preventing the development or spread of slums or blighted, deteriorated or deteriorating areas, discouraging the loss of commerce, industry or employment, increasing employment or any combination thereof” (§7-11B-7(d)(4)); and

- “a county commission may not enter an order approving a development or redevelopment project plan unless the county commission expressly finds and states in the order that the development or redevelopment project is not reasonably expected to occur without the use of tax increment financing.” (§7-11B-7(f))

Why is this important?

Jefferson County Foundation supports the tourism industry and this type of development. We also understand that the local government needs funds to operate and the importance of having a high quality well-funded public school system. We support fair taxation and effective economic incentives.

- If this $30,000,000 is diverted for 30 years from the county, the school system and the municipality to pay for the development of this hotel, then the deficit will have to be made up somewhere or schools, services, and infrastructure will suffer. This burden (either of extra taxes or deteriorating public services and schools) will fall on local small businesses and homeowners. This will make it harder for local small businesses to succeed. This is not fair taxation or an effective economic incentive.

- These incentives are meant to encourage developers to take on the risk of developing an undesirable location to prevent that area from becoming blighted or to improve a blighted area. While the old hotel is certainly in severe disrepair, this is not an undesirable location and it is one of a kind. A developer could not simply build the exact same thing in a different location to the same effect. The developer does not need to be incentivized to locate its Harpers Ferry Hill Top Hotel at the Harpers Ferry Hill Top. This is not an effective economic incentive.

- This project has been in the works for years and the developer had fought hard at many levels to make this happen. It is not reasonable to think that the developer would walk away now if they did not get this financial assistance from the local tax base. This is not an effective economic incentive.

- Thirty years is an unreasonable and long amount of time. Just think, a child born on the day the TIF takes effect will have children of their own halfway through elementary school before the school system sees any tax revenue benefit from this development or even from the appreciation of the land in this district. The parents of the child born the day the TIF takes effect will spend a majority of their working years contributing extra to help fill the deficit made by this TIF. This is not fair taxation.

Tell the Commission to Vote No

There is a public hearing at the Jefferson County Commission on Thursday, August 17 at 6:00 p.m.:

County Commission Meeting Room

located at the Old Charles Town Library

200 E. Washington Street, Charles Town, WV

See the full packet submitted by SWaN here.